In-Depth Review of CT Budget Guardrails Provides Analysis to Inform Policy

As policymakers debate the future of Connecticut’s “fiscal guardrails,” this series of papers offers a data-driven analysis of the guardrails, their impact, and a framework for considering possible adjustments.

In 2017, following years of shortfalls, mid-year deficit projections, and declining confidence in Connecticut’s fiscal future, the General Assembly enacted a set of revenue, spending, and borrowing caps known as the “fiscal guardrails” to promote fiscal stability and responsible budgeting. Together, these caps represented a broad and overlapping set of budget controls.

The guardrails have helped to stabilize the state’s fiscal position, but they leave policymakers with limited flexibility to meet current needs or make other future-oriented investments.

The adoption of the fiscal guardrails coincided with an accelerating economic recovery and a substantial increase in revenues from multiple sources. The guardrails helped Connecticut build up its Budget Reserve Fund or “rainy day fund” and make substantial supplementary payments into its underfunded pension system – an important priority for a state with some of the largest unfunded liabilities in the country.

At the same time, the guardrails have imposed increasingly stringent limits on the state’s ability to use existing revenues to meet current needs or make future-oriented investments. Legislators confront growing demands in areas such as education and childcare, non-profit and nursing home support, infrastructure, and Medicaid costs, along with rising costs of delivering current services.

Beyond the long-term challenge of paying for the mistakes of the past while meeting the needs of the present, policymakers face a more immediate challenge: a sizeable near-term budget cliff, as Connecticut faces its first budget in recent years without substantial amounts of federal assistance to supplement state revenues. Without adjustment, the guardrails will require severe austerity measures – forcing deep cuts, despite a sizeable surplus.

Balancing these competing priorities won’t be easy, but there are options available for policymakers to consider.

This series of briefing papers provides an informed and data-driven examination of Connecticut’s fiscal guardrails. They offer a framework for considering future adjustments that continue to protect fiscal discipline while increasing flexibility.

“Introduction to the Series” provides context for the guardrails and the series itself. “An Overview of the Caps” provides an introduction to the guardrails as they are currently designed.

“Stakes of the Debate” takes a deeper look at both:

(a) the looming challenge Connecticut faces as the exhaustion of ARPA funds, increasing costs, and the fiscal guardrails together leave the state with a substantial current services budget gap (despite projecting sizeable surpluses that are “off limits” for appropriation) and

(b) Connecticut’s long-term liabilities, which remain daunting.

“The Volatility Cap: A Closer Look” and “The Spending Cap: A Closer Look” examine in greater detail the design of the volatility cap and spending cap, respectively, and offer alternatives to the current design.

Finally, “Impact of the Caps” reviews the effect that the guardrails have had, both in strengthening Connecticut’s long-term fiscal position and in constraining budgetary flexibility and shaping spending trends.

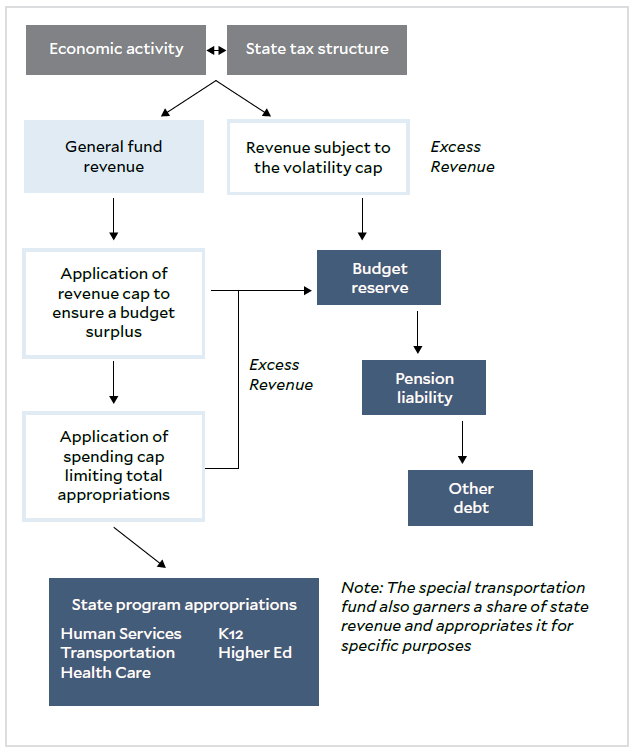

Diagram of the interaction between Connecticut's fiscal guardrails

Modifications to the existing spending cap, revenue cap, and volatility cap can be understood as falling into one of three categories: changes to calculation of the base, changes to the calculation of the growth rate or adjustment, or changes to the consequences of reaching the cap. The first two of those possible adjustments each receive more substantial treatment in this series in the context of the volatility and spending caps.

In particular, these papers offer potential frameworks for adjustment, including:

- Modifying the volatility cap by applying alternative deflators to the existing base or employing a dynamic model (a rolling average) to set the threshold rather than pegging the cap to an arbitrary initial year threshold.

- Modifying the spending cap in order to address the downward shift that resulted from insufficient revenues in FY16–FY18.

These papers support the fundamental premise that the guardrails have played an important role in stabilizing Connecticut’s fiscal position, growing the Budget Reserve Fund and strengthening the state’s grievously underfunded pension funds. They also embrace the proposition that examining the design of Connecticut’s fiscal guardrails is a worthy and worthwhile endeavor. A data-driven approach is critical, as policymakers consider their options in the months and years ahead.

Authors

Zachary Liscow

Zachary Liscow is professor of law at Yale Law School, served as chief economist at the Office of Management and Budget at the White House from 2022–2023, and was a staff economist at the White House Council of Economic Advisers from 2009–2010. Liscow earned his PhD in economics from the University of California, Berkeley, and his JD from Yale Law School, as well as a degree in economics and in environmental science and public policy from Harvard College.

Luke Bronin

Luke Bronin is a visiting lecturer in law, senior research scholar in law, and Tsai leadership senior distinguished fellow in residence at Yale Law School and most recently served two terms as Mayor of Hartford, Connecticut. Bronin was general counsel to then-governor of Connecticut Dannel P. Malloy from 2013–2015 and prior to that served in the Obama administration at the US Department of the Treasury. Bronin was an officer in the US Navy Reserve. Bronin received a BA from Yale College, an MSc from the University of Oxford, and a JD from Yale Law School.

Nat McLaughlin

Nat McLaughlin is a policy fellow at the Tobin Center for Economic Policy, previously held the role of policy advisor to Connecticut’s Chief Budget Officer, and also served as a naval officer. McLaughlin holds a MA in global affairs and an MBA from Yale University, a Master’s in national defense and security studies from the US Naval War College, and a BS in industrial engineering from Northwestern University.

Patrick J. Murphy

Patrick J. Murphy is a professor and faculty director for the Urban and Public Affairs program at the University of San Francisco. He currently serves as the director of resource equity and public finance for The Opportunity Institute. Previously, Murphy worked at the US Office of Management and Budget, as a consultant for state and local government, and at Arnold Ventures. Murphy received a BA from the University of Notre Dame, an MPA from the University Texas-Austin, and a PhD and MA from the University of Wisconsin-Madison.

Mohit Agrawal

Mohit Agrawal is an applied microeconomist and a fourth-year PhD candidate in economics, a graduate policy fellow at Yale’s Institute for Social and Policy Studies, and a visiting scholar at University of Chicago’s Becker Friedman Institute. Agrawal served as deputy policy director and advisor to Governor Ned Lamont of Connecticut from 2019–2021. He received his BA in mathematics from Princeton University, and an MSc in applied statistics, as well as an MBA, from the University of Oxford.

Eliza McKenney

Eliza McKenney is a research and policy program manager at the Tobin Center for Economic Policy. Prior to joining the Tobin Center, McKenney worked in economic consulting at Cornerstone Research where she collaborated with leading economic and financial academics. McKenney holds a BBA in finance and a BA in psychology from the College of William & Mary.